Jim Tobin, A Friend Of Liberty (1945-2021)

May 2nd, 2022

“The surest way to wealth during the Covid economy is to have an Illinois state government pension,” said Matthew Schultz, executive director of the Taxpayers Education Foundation (TEF). “TEF has analyzed the six major pension funds, and the first study we are going to release is about the worst offender: GARS, (the General Assembly Retirement System).”

“GARS is filled with former Illinois politicians who are absolutely raking in the money! According to our report, 246 taxpayer-subsidized pensioners within the system will receive payouts of at least a million dollars over their lifetime. This is because, on average, retirees within the system only pay 5.4% of this amount into the system. In other words, for every $5.40 spent on their pension, retired politicians will receive a guaranteed $100 during their lifetime.”

“Besides direct contributions into the fund, there are two other notable forms of funding, investment revenue, and money taken from taxpayers. However, what is often not understood about the fund is that the overwhelming majority of its cash influx comes directly from taxpayers.”

“In the year 2018, politicians paid $1,284,707 into their own pension systems. $5,140,250 came from investment income, and a whopping $21,721,000 was paid by taxpayers. Basic calculations tell us that for every dollar added to the fund from either politicians or investments, taxpayers added $3.38.”

“In just a few years, the situation has greatly changed. According to our latest numbers, politicians have deposited, $1,205,930 less than the year before. Following the trend, investment income has been slashed to $2,581,064. Meanwhile, as Illinois residents continue to suffer from economic hardship brought about by statewide lockdowns, Illinois taxpayers paid into GARS an astounding $25,754,000. Now, for every dollar added to the fund from either politicians or investments, taxpayers added $6.80.”

“Thanks to the iron grip on taxpayers’ wallets during the politician-inflicted slump, the fund has improved its position. The fund now has 16.50% of the assets required to make retired politicians millionaires. It only needs $319,263,796 more, mostly from taxpayers. This, assumes of course that the situation doesn’t get any worse.”

“To give an example of the pensioners within the fund, here is a list of some. Keep in mind, these are only the pensions from GARS, and do not include other pensions they may be receiving.

“James Edgar (R), famous for playing a part in breaking the already broken pension system, receives an annual pension of $181,230. He only paid $164,657 into the system, and is estimated to receive $4,771,192 by the time he is 85 years old. His annual pension, like every GARS pension, is subject to a compound 3% cost of living adjustment increase every year. It is the driving force behind the Illinois pension crisis, and why Mr. Edgar’s lifetime payout is so enormous.”

“Former governor, Patrick J. Quinn Jr. (D), the so-called “reform” governor, currently receives an annual pension of $149,882. He has received a total pension to date of $694,733. His estimated lifetime pension payout is $3,255,658.”

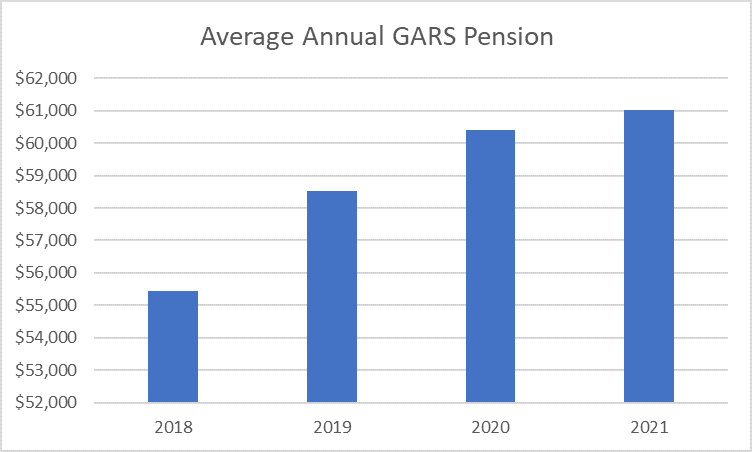

“According to estimates, the average GARS recipient receives $61,027 annually, with an estimated lifetime payout of $1,420,329. The average years ‘employed’ in this part time job is 14.8 years before retirement.

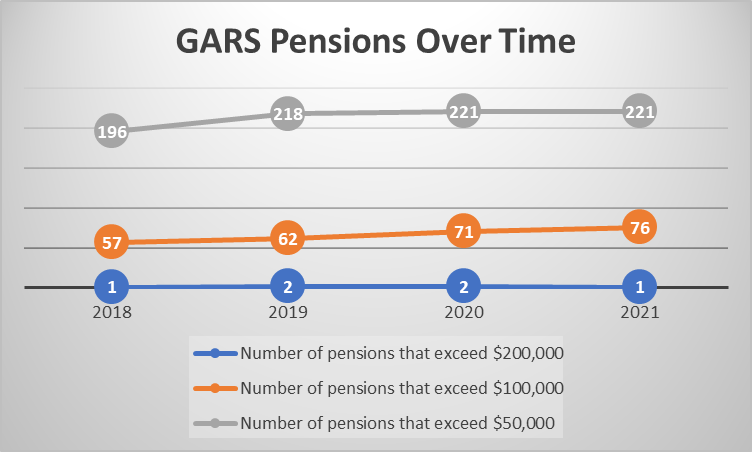

“In GARS, there are 221 recipients who are estimated to collect over $50,000 a year in GARS pensions annually, 76 of whom receive $100,000 or more annually, and one-member, lucky Edward F. Petka, receives over $200,000 annually. There are only 427 members within the fund at this time.”

“While GARS is the smallest of the six major pension funds, its it a microcosm of the greater Illinois government pension crisis. The pension system is skewed to give out enormous payouts with little employee input. The system has no money, and is not kept afloat by brilliant investors but by frantic grabs at taxpayer dollars at the expense of the rest of the Illinois state budget. It is a system that has already blasted past its breaking point.”