Jim Tobin, A Friend Of Liberty (1945-2021)

May 2nd, 2022

Illinois taxpayers are being subjected to a relentless campaign to frighten them into supporting a huge increase in the state gasoline tax, including the claim that the state’s bridges are failing. But, according to transportation expert Randal O’Toole, engaged by Taxpayers Education Foundation (TEF) to study the issue, the facts tell a very different story.

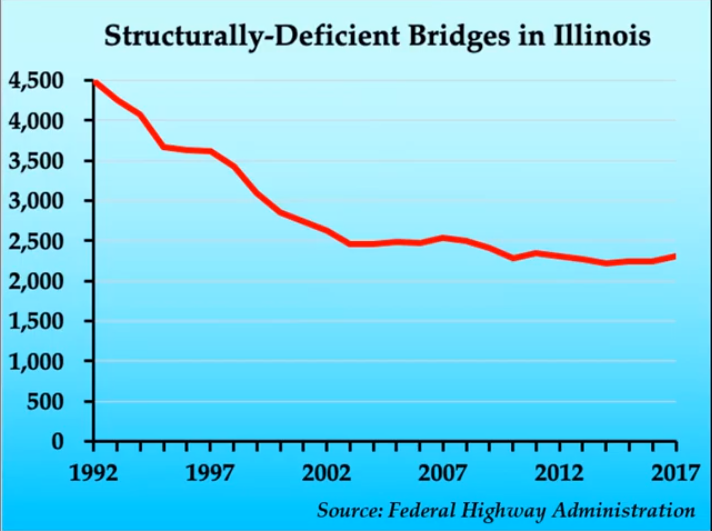

The last time a bridge fell down in America due to lack of maintenance was more than 30 years ago. That event sent a wake-up call to the U. S. Dept. of Transportation to inventory and remedy structurally-deficient bridges. Since then, the number of bridges that were structurally deficient in Illinois has fallen by 50 percent. Most of this decrease took place between 1992 and 2009. But, since 2009, the decrease has flattened out.

Additionally, using the Highway Roughness Index, Illinois roads have actually become smoother than they were in 1995, especially the Interstates, but also other roads.

In other words, roads and bridges are in better condition than they were 30 years ago, and are getting better every year, so the notion that we need to raise taxes to fix them is not valid.

It’s important to note that most of the various gasoline taxes that Illinois drivers pay are not going to roads. Of the state 19 cents-a-gallon state tax on gasoline, in recent years, only about 13 cents of that has been going to roads. Almost 6 cents has been going to Chicago transit systems.

Of the state’s 19-cents-a-gallon gasoline tax, before 2009, all of the money was spent on roads. Since 2009, about 25 to 30 percent of state gasoline taxes as well as state motor vehicle registration fees have been diverted to transit systems.

The number of the state’s structurally-deficient bridges had been declining up until 2009. Since 2009, the decline has tapered off, and in the last couple of years, the number has increased slightly. If state gasoline tax funds had not been diverted to Chicago transit systems, there would have been plenty of money to devote to fixing the state’s bridges.

Bottom line: the state has been misallocating the money from gasoline taxes.